US indexes found a little bit of selling into the weekend after a strong week.

Leaders closed down 0.5% but under the hood, it was a bit of an uneventful night.

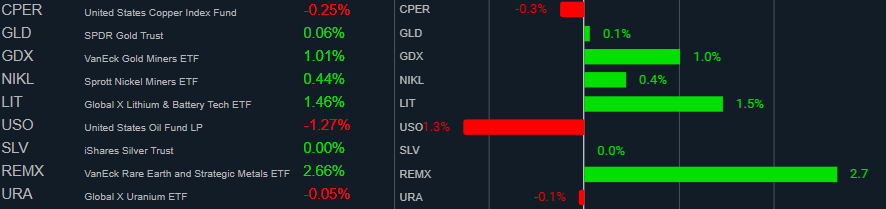

Of note, TAN (solar) was +8.8% and commodities found some buying with rare earths +2.6%.

We have potential peace talks with President Trump and Putin, and we head into peak earnings season in Australia over the next two weeks. So volatility will remain high.

The markets have been very strong, subject to being in the right names. The more speculative end of the market is working here and the rotation trade has worked.

Commodities again strong, with the rotation trade continuing to work in Australia:

To hear more about us and our services, please don’t hesitate to contact us below:

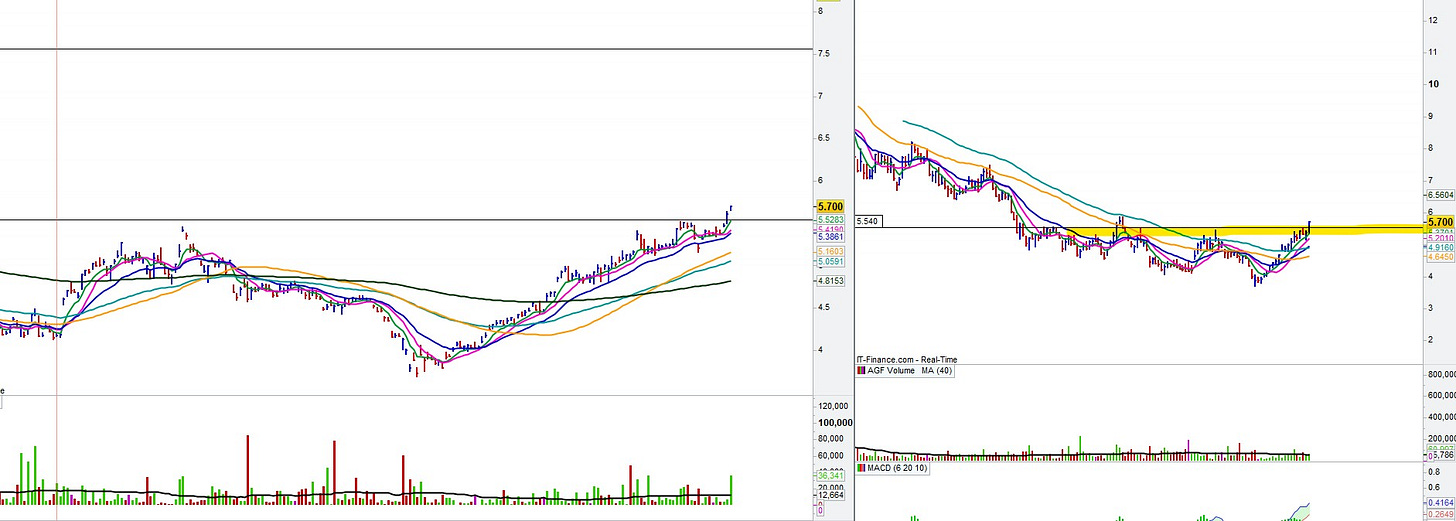

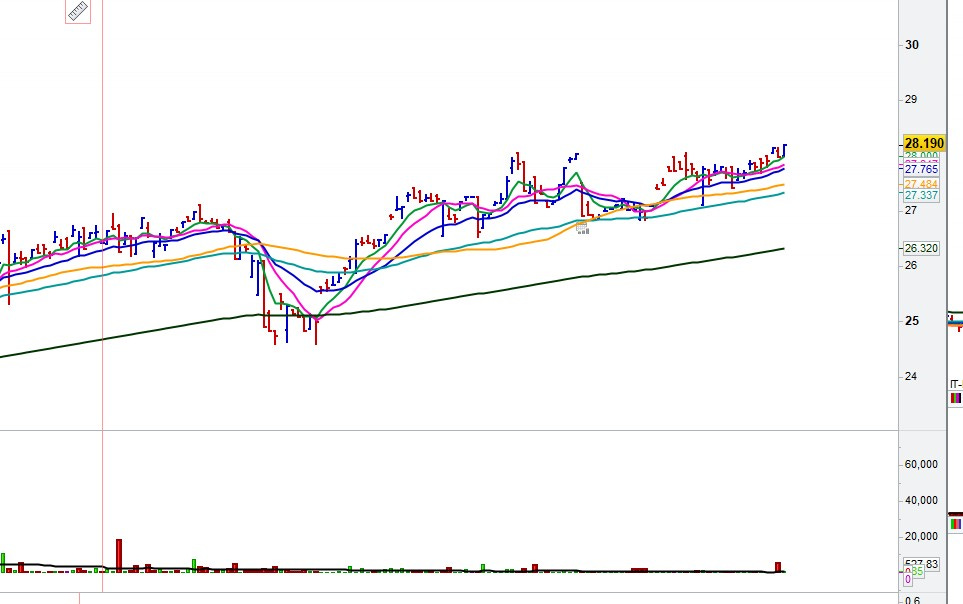

Charts of Interest

Below are select charts of interest, as always, additional content is posted on the main site, feel free to acess via a free 2-day trial here

To open a brokerage account, or for any membership enquiries, please feel free to contact us.

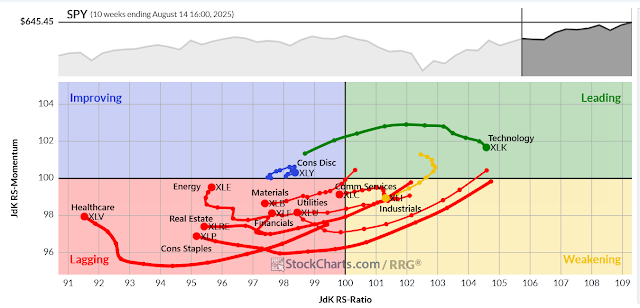

The Relative Rotation chart of U.S. sector returns shows tech as leading, which exemplifies the narrow market breadth which remains there. Ideally we see participation broaden there:

XJO a little extended in the short term but in a strong uptrend

ATEC – Aussie tech is strong and we will see how much or little RS is needed

ASIA (an ETF) in the third push in the short term but has been very strong

DRIV – electric vehicle – interesting if a new primary base can be made here

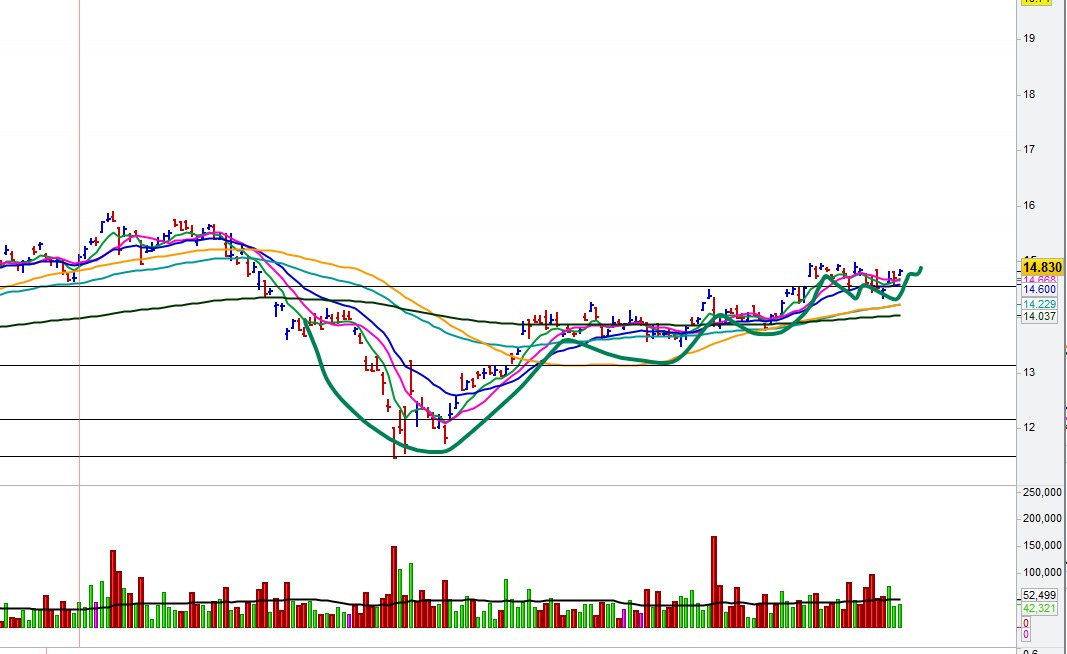

XMET – energy transition. As discussed, I think we are at the beginning of a new energy bull market

RBTZ – robotics pulling back to the base

QRE – resource sector made the turn and likely put in a cycle low

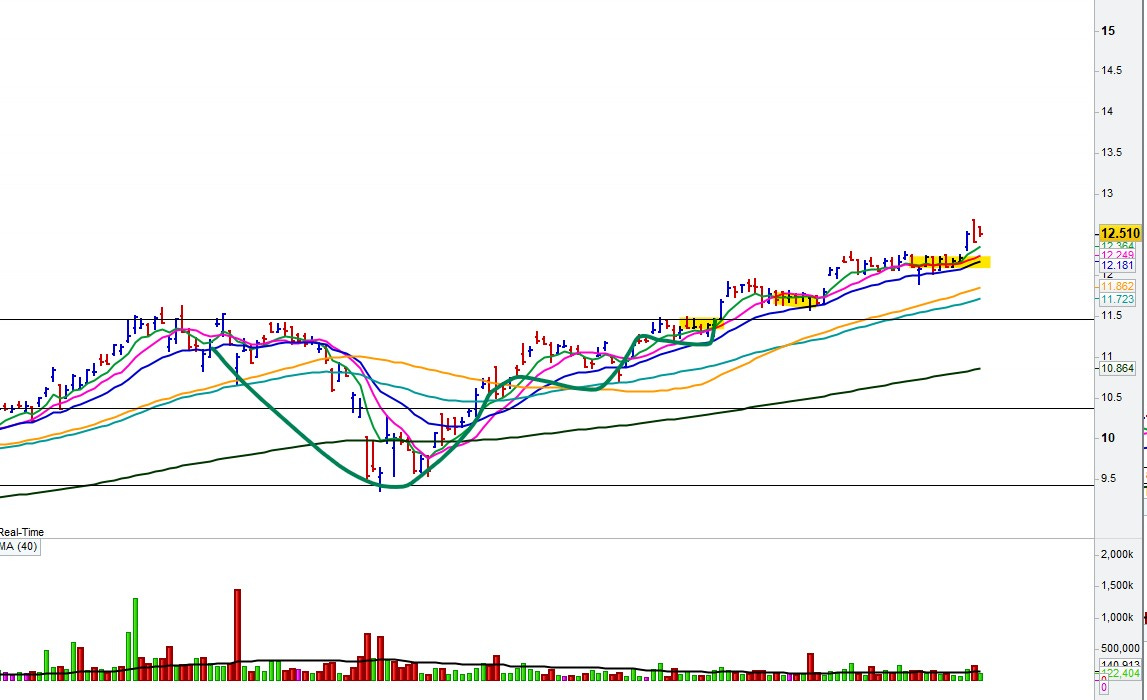

HGEN – hydrogen in a strong short term uptrend and coming out of a stage one low (weekly)

WIRE – copper, a little extended in the short term but that is a weekly BO. Ideally, we get a PBB to base

GREK – Greece, a solid 55% trending move….

VNM – Vietnam, another country in a booming bull market

WEMG – emerging markets coming out of BOwP style base