In our last post we mentioned we wanted to see support and that:

“we now have the short term support - a good time to assess relateive strength of leading names.”

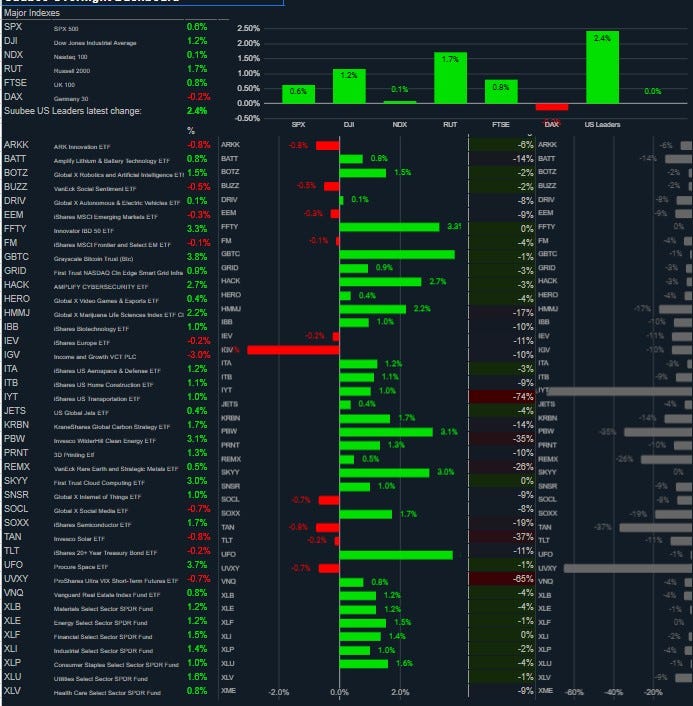

Since then we have seen strong price action. Last night again a strong night for Suubee Leaders +2.4%, with some of our smaller names finding large moves (RDDT NNE, RKLB). Many of those FPB worked from aggressive points which is interesting feedback and highlights that volatility (ideally) alpha is here to stay.

The escalation in Ukraine is going to be a key market mover over the coming weeks so expect President-Elect Trump to try and defuse the situation, while the current administration seems to want to support Ukraine attacks.

Whatever your view, this has the ability to really escalate a response from Russia. So have a plan ready for your positions and remain flexible.

Capital seemed to flow back into markets last night, Europe found some support from that base low (STXE) which will be interesting to monitor, while the DOW and Russell led the US index move. Our small/medium caps have worked very well over the past few sessions and have provided some rapid returns.

We will run through some in the Suubee Premium webinar today and discuss management tactics as it is a very fast market now, expect volatility to stay heightened.

Lets see how these US indexes play out here from this DTP.

To open a brokerage account, or for any membership enquiries, please feel free to contact us at the below link:

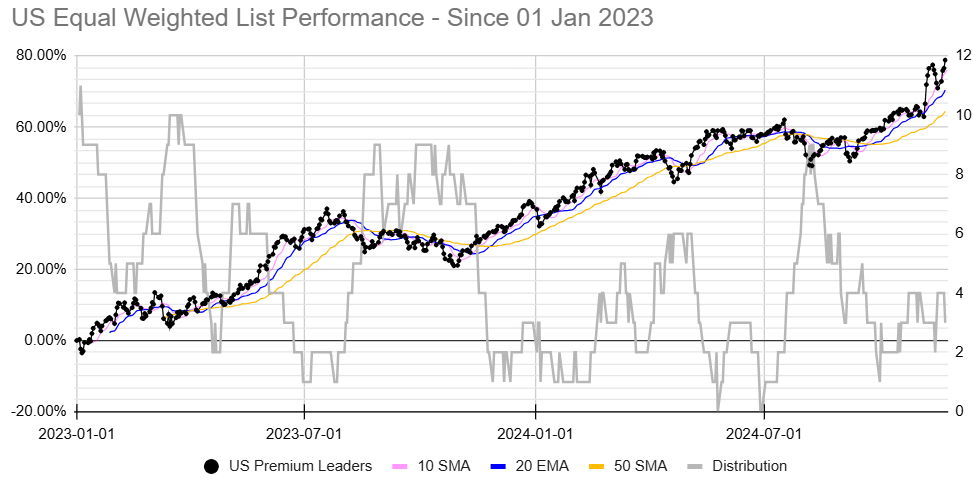

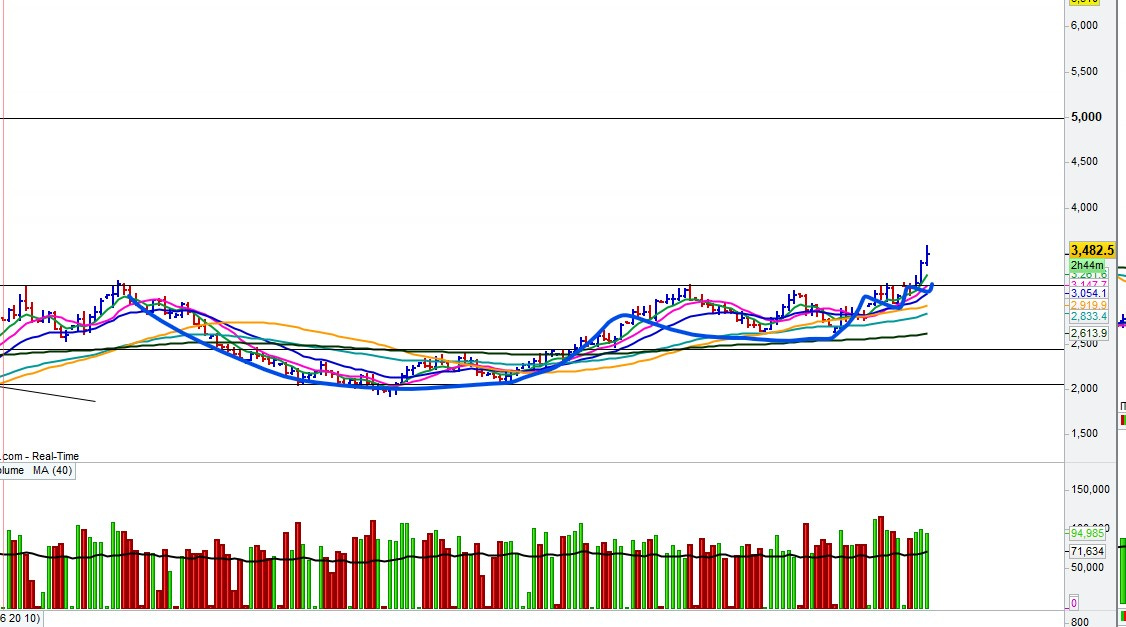

US Leaders list, equal weighted, a huge move post-trump with a nice BoWP, we saw a sharp pullback with nice support from the 10d MA this week:

Overnight movers:

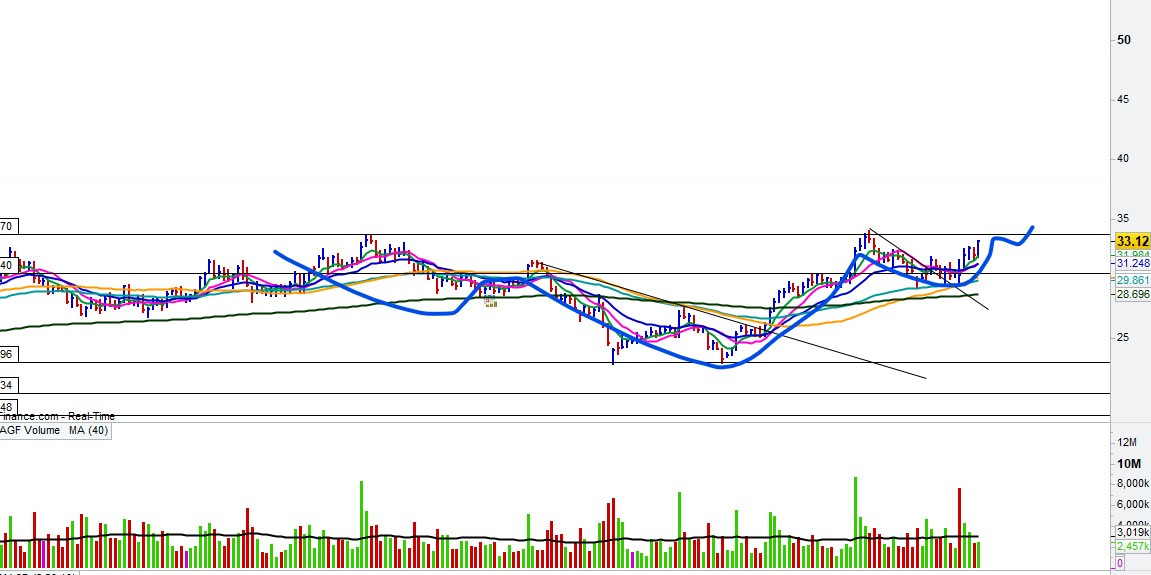

Charts of interest:

Below are select charts of interest, as always, additional content is posted on the main site, feel free to acess via a free 2-day trial here

XJO – banks have been strong as have some defensive names while leaders have been choppy – does that switch?

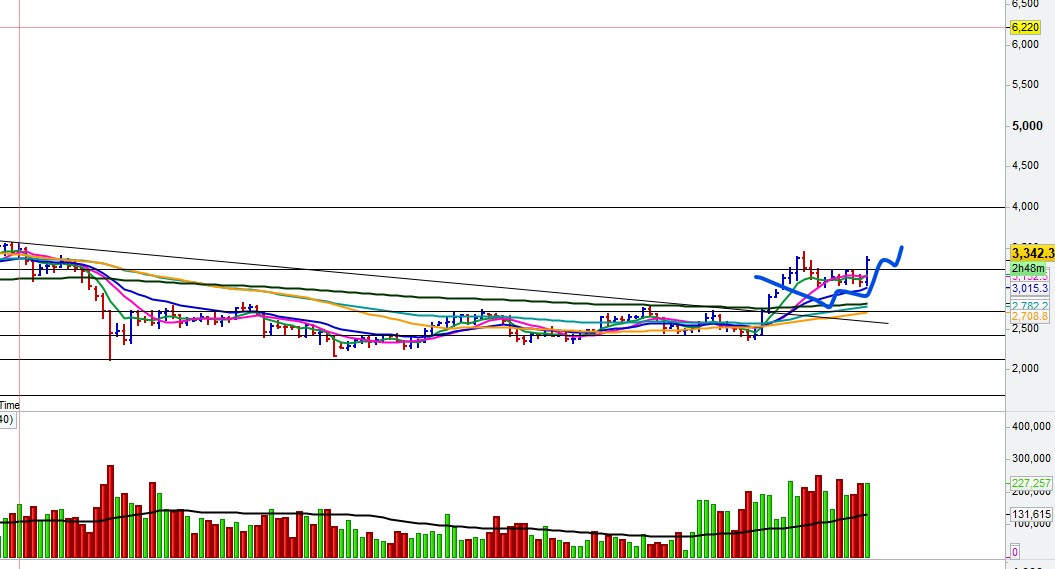

Bitcoin working its way up to that 100k. Cypto names remain strong

ETH (cypto) pushed from that DTP

Lithium – dare we say a bottoming pattern is starting to form (needs time)

URA-uranium is starting to set a decent-looking base

ISO – Aussie small cap in a tough spot, we want it to hold this structure, rather than break down

Nat Gas pushed well from this stage one

Gold – pushed well from support and is holding well with rising tensions

SKYY – cloud continues to act like a leader

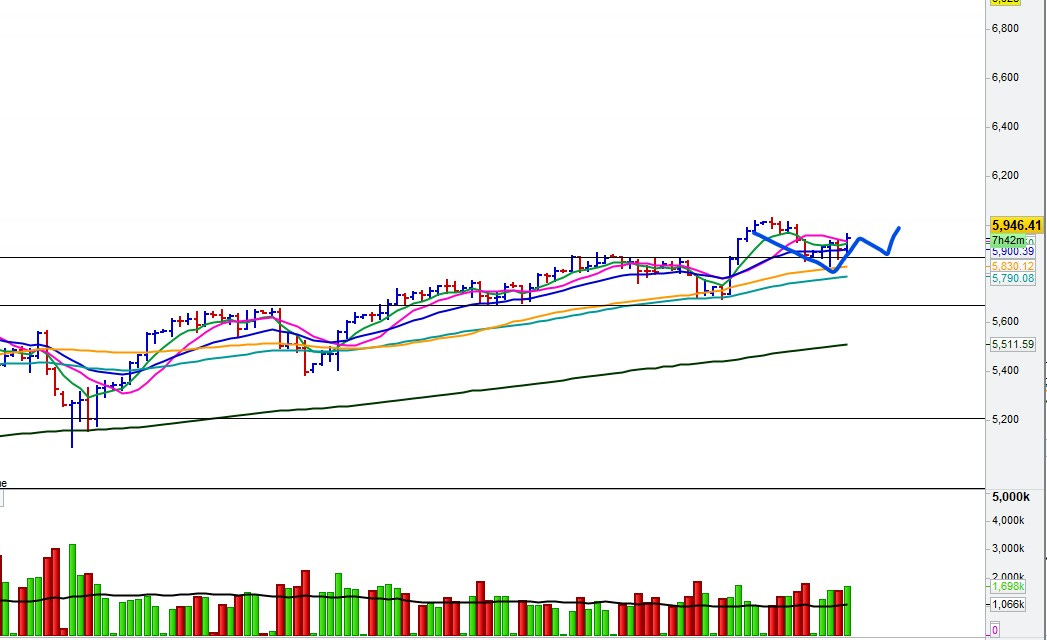

S&P – holding that recent test of supply. Leaders are strong which is pleasing

Russell – found support from the base

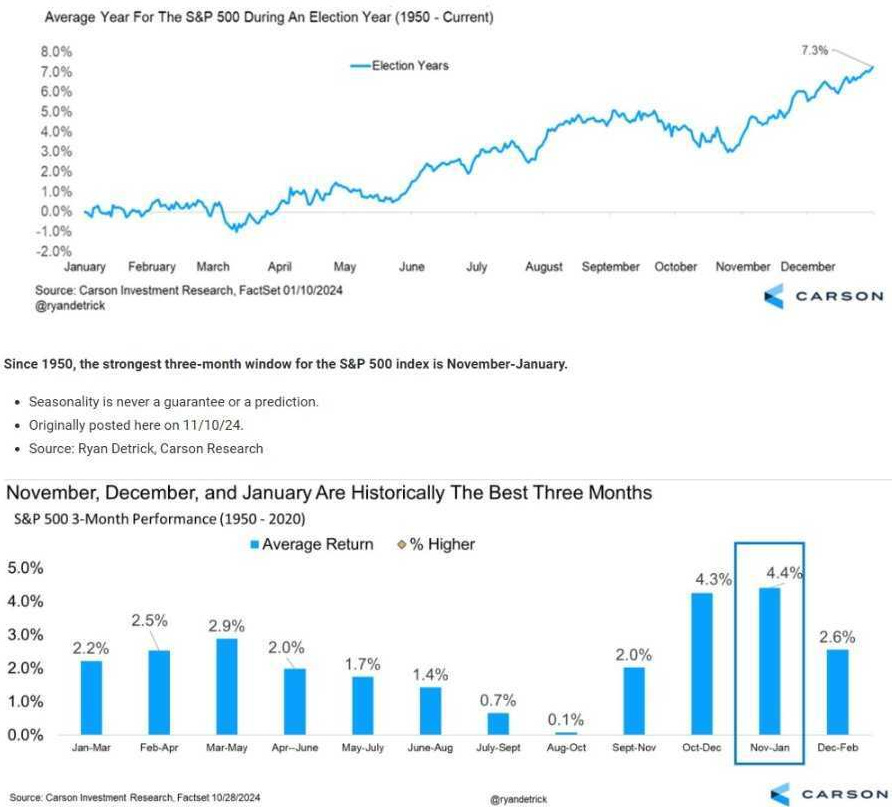

Seasonally a bullish period for US stocks in election years, geopolitical risk aside: